Continuing on from my previous post on what’s worked for me over the years.

Pay Yourself First

Paying yourself first is a staple of personal finance recommendations, but that doesn’t make it any less relevant or even easy. In a nutshell, the idea is you don’t pay off debt, build your emergency fund, your retirement and investment portfolios from what’s left over from your paycheck, but rather these things come out first.

Also know as reverse budgeting, the idea is that you don’t set your budget based on your prior spending habits, after all where would that leave you if hadn’t been living below your means? Deeper in a hole.

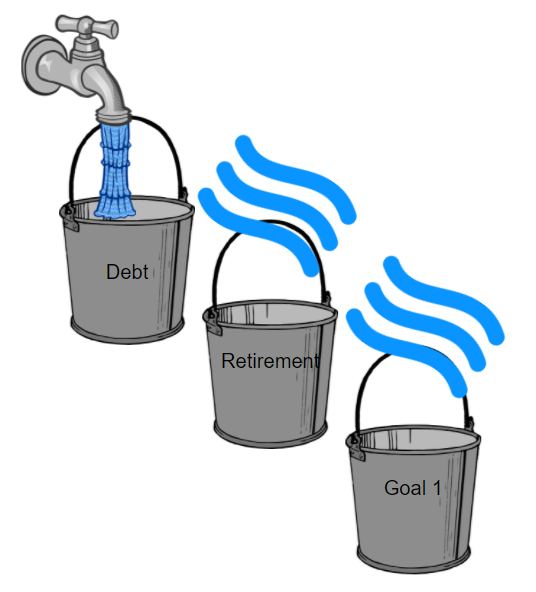

Rather, you start with your saving priorities and allocate your available cash flow to your highest priority first, then if there’s cash flow left, the next priority, and so on through your main budget categories. I like to think of it as saving buckets, and as one fills up money starts flowing out of that bucket to the next.

So in our example to the left first you would allocate your free cash flow to pay off your outstanding credit card debt, then to retirement, then on to your next goal when you had met your retirement savings goal for the year.

An alternative is to set a target date for example paying off your debt in X months, then divide the debt and projected interest by X, do that for your retirement goal for the year, and then allocate any left over to other savings goals. This way while you are paying off your debt you are making some progress against other goals. I would argue that if you have a credit card debt, that interest is so egregious you should prioritize paying that off over everything else, but the most important thing is your system has to work for you.

Employer sponsored plans like HSAs and 401(k)s (or the TSP for those in the military or other Federal service) where the money is literally deducted from your paycheck before you get your hands on it are a great idea, and if you aren’t maxing these out I would strong recommend allocating any future raise to doing so before you start letting lifestyle inflation creep in. Lifestyle inflation will literally kill your chances of being financially independent.

With many employers, you can set up a separate payment of a set amount to a savings account separate from your paycheck deposit account, say a $200 a paycheck deduction that goes into your emergency fund directly. This is a great way to build up saving without having to really think about it.

Other goals, or you if can’t set up an allocation like this, brings me to my next lesson.

Automate Everything

We live in a time when all our financial service providers are trying to win at Customer Experience management. This means they are always looking for ways to make things easier for us as customers. (Well except for companies using dark patterns to trick us into spending more, but that’s another website.)

Because we humans are of limited will-power, time, and attention, take all these things out of the equation. Make it so you’d actively have to stop yourself from saving and investing.

- Set your 401(k) to annual increase it’s percentage until you’re maxing it out

- Set up automatic transfers to build your emergency fund

- Do the same with other goals to separate savings accounts, we have one each for: cash reserves, taxes, travel, property maintenance, dining out (when we started doing this years ago we opened separate savings accounts for each, but now many banks let you set up multiple savings goals/buckets/whatevers within a single account.)

- Put all your bills on your credit cards, which also helps maximize points

- Have your credit card bills in turn set to auto-pay, just maintain a cash balance in your checking to cover your average spending

- While you’re at it set up balance alerts so you know right away if you don’t have the buffer you’d normally want

- Have all these accounts aggregated on a platform like mint or Personal Capital so you can monitor them all in one place

* I am not a financial professional or consultant, none of this information should be taken as advice for your specific financial and personal situation. Do your own research and form a plan that is appropriate for you.

Photo by Francesco Gallarotti on Unsplash