I originally wrote this for another blog during the severe COVID volatility of 2020, and with the return of uncertainty and market gyrations, I thought it would be a good time to dust it off and share the 3 strategies I have used to build wealth during times of volatility.

From my perspective there are only three things you should be doing with you investment portfolio right now, depending on your risk profile, and the state of your non-investment finances.

1) Go All In

If you are young, bold, flush with cash, or some combination of the three, then you should look at this as a stock sale and deploy all your available cash to buy stock, and boost your 401(k) withholding while you’re at it.

“But wait”, you say, “shouldn’t I wait until the market hits bottom?” or “But it’s too late, the market already hit bottom!” No, no one can predict the bottom of the market, and worse no one can predict the day the next Bull market starts, and missing the start of a recovery, or the even just a few of best days, can cost you serious returns.

Had someone invested $10,000 in the S&P 500 on Jan. 1, 2002, they would have a balance of $61,685 if they stayed the course through Dec. 31, 2021.

If instead, they missed the market’s 10 best days during that time, they would have $28,260.

CNBC

If you can’t stomach going all in at once, then buy the dips, or give yourself a daily limit and put that much into the market per day. There are good arguments against this kind of short-term dollar cost averaging, but in my book it’s better than sitting on your hands. This is what I did during the Great Recession as I watched my years of hard savings and investing cut nearly in half. Once I was out of free cash, I had to wait for each paycheck and invest my free cash flow.

Part of what gave me the confidence to do so was that at that point, I had just returned from a deployment to Iraq with the Guard, and my wife had built our emergency fund up to 12 months expense (and she had also managed to cut our expense 20%, so there was that boost too). If you don’t have an emergency fund, put money there first until you are ready to put your free cash in the market.

2) Have Faith In Asset Allocation

Disciplined investors, as opposed to traders or speculators, need to have a clear view of what their asset allocation plan is. Now there are tons of different models and advice out there for what the ‘correct’ mix is. If you are coming at investing from a FIRE perspective you really should be pretty aggressive in your stock target, but even if you follow some of the other advice, such as being 120 minus your age in stocks with the balance in bonds, you will reap the benefits of asset allocation.

When I first started working I was 100% in stock, then in my 30s moved to the method mentioned above, so for example at 35 my target allocation was:

- 85% Stock / stock funds

- 15% Bond index funds

I was headed down the slow path from heavy stock to 53/47 upon retirement at 67. Along the way I was winnowing out stocks and dumped all my actively managed funds in favor of index funds.

(As an aside this has helped bring the fees I’m paying down to 0.04% from over 1% when I first started investing, but that’s a whole other post.)

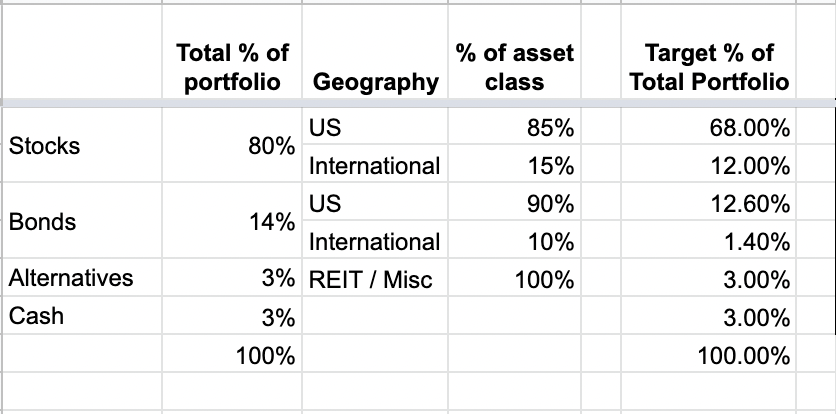

Then, thankfully I started reading some really contrarian thinking in the form of the various FIRE bloggers. I looked at my own risk profile, and settled on the following target asset allocation plan, which I intend to keep indefinitely.

A few notes on this:

- You really could just go Stocks and Bonds on this, Jim Collins has made a compelling argument that you already get international exposure with Total Market stock and bond index funds. By breaking up my Stocks and Bonds targets into US and International, I’ve made my rebalancing more complicated, but I like to be more hands on, so this is definitely an area you could simplify for yourself.

- ‘Alternatives’ in my case is just one thing – real estate in the form of the Vanguard Real Estate Index Institutional (VGSNX) available in my 401(k)

- Cash I have in there just to keep some cash on hand to buy dips. The reality is that if you use a good asset allocation monitoring tool like Personal Capital it will surface the amount of cash your mutual funds actually have sitting around which is usually close to 1%.

- Essentially, I have one fund per asset class in column D, which is not too hard to manage.

- While I do hold crypto, I consider these as purley speculative, and not part of my investment portfolio that I plan my financial life around.

All well and good so far, we’ve settled on our target asset allocation, and we’re ready to enjoy the rewards of balancing risk, and get on with the rest of our life, right?

Active Rebalancing

Unfortunately, no. Mind you that I have been saying target asset allocation all along. Our actual asset allocation is going to change as the markets go up and down, and as we put more money in, even if we’ve set our 401(k) new contributions to match our target (which we should.)

We have to regularly rebalance our investment portfolio, and there are a few ways you can do this, especially while you are still contributing:

- Selling those asset classes that are over allocation and using that money to buy funds in asset classes that are under allocation.

- Adding new money in your taxable brokerage account, and just buying those asset classes that are under allocation.

- Adjusting future 401(k) contributions to over-weight those classes that are under allocation.

- Some combination of the above

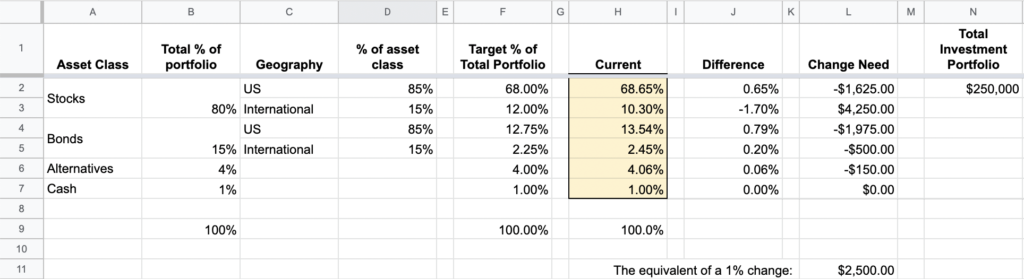

So what does this look like, you might ask. Let’s take a look at where my asset allocation stood at the end of last weekend, with a hypothetical portfolio value of $250,000

I use Personal Capital to track my portfolio, and I really love their allocation view, below.

I simply paste the values from there into a spreadsheet I built for myself. This let’s me not only see where I am over/under, but also by how much. Generally I ignore anything less than 1% as noise, so in this hypothetical scenario above I would only focus on the International Stock asset class, which is 1.7% under allocation, and figure out how to buy as close to $4,250 as I can.

How often you do this is probably a matter of taste, and whether or not looking at your losses makes you anxious. I’ve read everything from once a year, once a quarter, to once a month. Personally, I would view once a quarter as the minimum, I checked mine at least once a month when I was tracking my progress towards FI (I love the Mad Fientist’s Lab for this.) I am pretty hands on though and when things are volatile I might check and move money once a week. If that sounds stressful to you then you definitely should not do so, I just happen to find satisfaction in staying on top of it.

Benefits of Asset Allocation

Be fearful when others are greedy and greedy when others are fearful.

Warren Buffett

Why go through all this trouble? There are several key benefits:

- Sticking to your model, and a rebalancing schedule forces you to buy low and sell high. For example, in December 2021, January 2022, and February 2022, my asset allocation plan forced me to sell stocks funds at their recent heights to boost my bond holdings, which stocks were leaving in the dust. Am I brilliant or what? Actually no, I just stick to the plan.

- This keeps emotion out of the picture, and forces you to be a disciplined investor, helping you avoid making costly panic-driven mistakes.

- Unless you are 100% stock, which I guess technically is an asset allocation plan, it helps reduce risk on the downside when downsides might make you break for the exits.

- It forces you to implement Warren Buffett’s famous quote above, and who doesn’t want to be more like Warren.

For example, during the COVID induced Stock Market Crash of 2020, THE most important decision I made that year was to stay invested in the market during the meltdown in March. I stuck to my asset allocation plan despite suffering a little over 25% drop in the value on my investment portfolio.

This has the effect of forcing you to by low and sell high – the exact opposite investors tend to do when allowing their investing to be governed by emotion and an over-estimation of our own abilities. Instead, as the market was falling, my bond allocation was growing, and I repeatedly sold bond funds in lots of increments of $3k-$5k and bought stock funds at lower and lower prices. Then as the market got into recovery, I had to move money back out of stock funds and into the now lower bond funds.

Sounds like too much work, and stress-inducing to sell stocks that are dropping. No doubt, I won’t lie and say I was sanguine thru the whole process, but I am committed to this process. More importantly, how did it work out?

By regularly rebalancing throughout the year (due to the volatility I was doing this 1-2 times a month) during the volatile 2020 I ended the year up 22.4%. However, that’s looking at my portfolio value at the beginning of 2020, but what I want to really, REALLY emphasize for everyone reading is that by the end of 2020 I was up OVER 50% from the lowest point of my portfolio value which was 3/23/3020. NO ONE can predict when the market will recover, and people who panicked and pulled out of the market to wait for it to recover will have missed most of that recovery.

So in the end, 2020’s so-called “V-shaped recover” really illustrates how important staying invested is to long-term investing success. During the volatility we are currently experience in 2022, I continue to rebalance and have bought several dips with the cash I have set aside for this purpose.

3) Do Nothing

No. 1 rule of investing: When you don’t know what to do, do nothing

Mark Cuban

The last option I’ll discuss is summed up by Mark Cuban’s quote above, especially if looking at your portfolio is likely to make you upset. Take a long break from looking at the market, turn off the news, go get some fresh air, and wait for the markets to recover, because they will. Just don’t turn off your 401(k) contributions.

At different points in my life I’ve done all 3. I was so shocked by the tech bubble bursting I did nothing. In the Great Recession I went all in buying all the way down every time I could scrounge up some cash. Nowadays, and for the foreseeable future, I’m sticking to my asset allocation plan.

And because I’ve stuck to one of these three strategies, well over 50% of my investment portfolio is made up of gains. Knowing this also helps remember that I haven’t lost anything if I don’t sell.

So don’t listen to industry pundits, do the work to define your asset allocation plan and stick to your strategy.

That’s it for today, share your thoughts and strategies in the comments.

Feel free to use my Asset Allocation Planner spreadsheet and make it your own. If you don’t have Excel, you can make your own copy of it from our Google Drive account, or just upload the Excel to Google Sheets.

Photo by Towfiqu barbhuiya on Unsplash